Dakota Gold – The Advancement Of The Richmond Hill and Maitland Gold Projects In the Historic Homestake District Of South Dakota

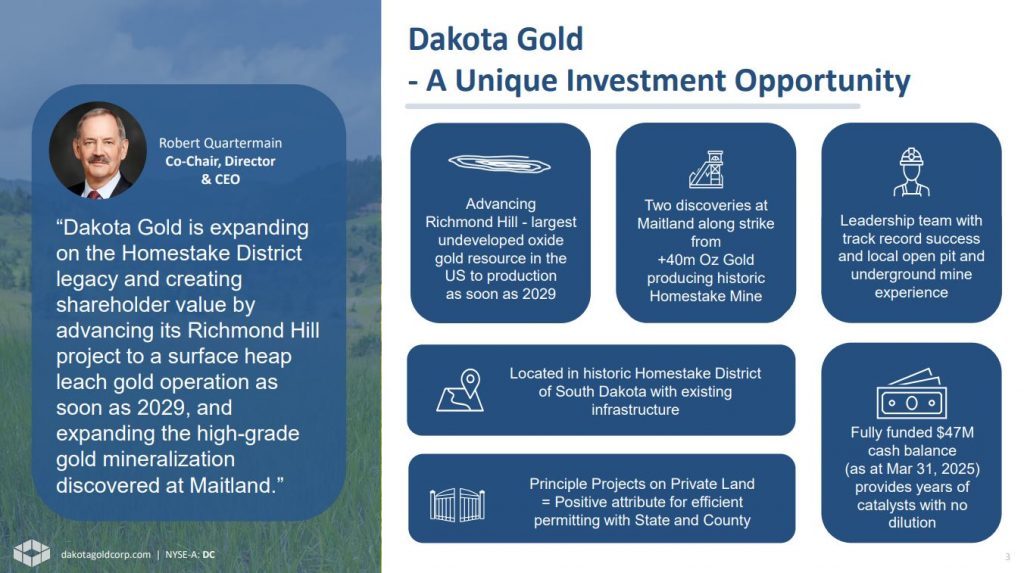

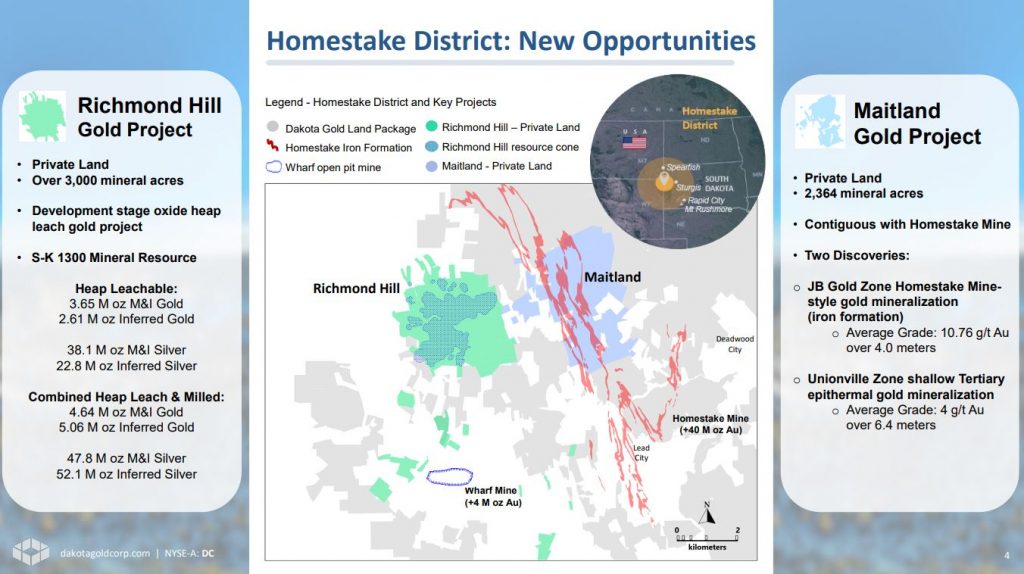

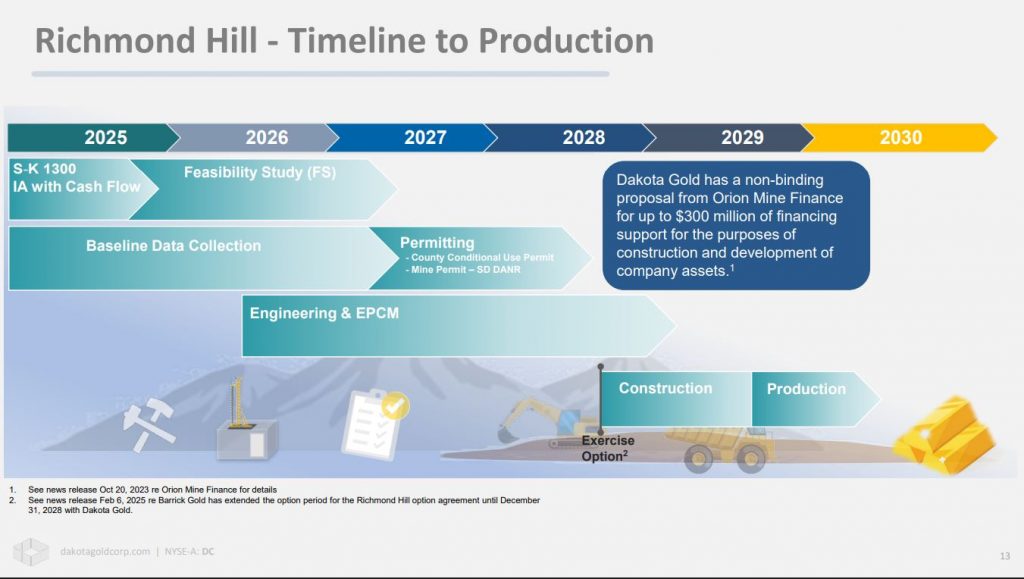

Dr. Robert Quartermain, Co-Chairman, Director and CEO of Dakota Gold (NYSE American: DC), joined me for an update on their Richmond Hill Project and Maitland Gold Project, both located in the historic Homestake District of South Dakota, near existing mining infrastructure. The company is advancing its Richmond Hill project toward eventual surface heap leach gold operation as soon as 2029, and expanding the high-grade gold mineralization discovered at the Maitland Gold Project toward an initial resource estimate.

We start having Robert share his background in the industry, as he was previously the Executive Chairman of Pretium Resources Inc., which he founded in October 2010. Prior to Pretium, he was President and Chief Executive Officer of Silver Standard Resources Inc. (now SSR Mining Inc.) for 25 years from 1985-2010. Not only does he have a wealth of experience in developing and constructing producing mines, but he has assembled a solid management team and board filled with industry veterans that have worked in either the Homestake Mine, before it closed down, or the currently producing nearby Wharf Mine, operated by Coeur Mining.

Richmond Hill is one of the largest undeveloped oxide gold resources in the United States being advanced by a junior mining company, with over 6 million ounces of gold and over 60 million ounces of silver moving along the pathway of development into heap leach production as soon as 2029. Principle Projects on Private Land which equates to a positive attribute for efficient permitting with State and County organizations.

S-K 1300 Mineral Resource (Heap Leachable):

- 65 M oz M&I Gold, 2.61 M oz Inferred Gold

- 1 M oz M&I Silver, 22.8 M oz Inferred Silver

Dakota Gold has engaged the current consulting groups based on their capabilities to deliver an Initial Assessment with Cash Flow (IACF) in mid-2025 (similar to a PEA). This economic study will be based on a 30,000 ton per day crushing circuit, and further the project towards ultimate production. The Company continues Feasibility planning with M3 as the overall Study Manager as well as the lead for processing, while RESPEC will manage the mining and environmental aspects

There are currently two drill rigs turning at Richmond Hill. In 2025, the Company expects to drill ~80,000 feet (24,384 meters) using a combination of Reverse Circulation and Core drilling. The primary focus of the program is to collect metallurgical samples for the Feasibility Study, infill, and expansion resource drilling in the northeast corner of the Project area. This area is expected to be mined at the beginning of the mine plan and is higher-grade than the overall deposit.

At the Maitland Gold Project the Company is currently assessing the exploration data collected to date from the JB Gold Zone and the Unionville Zone with the intent of outlining an initial inferred gold resource. The work is expected to be completed in the fall of 2025. To date the JB Gold Zone has encountered a number of high-grade intersections which average 10.76 g/t Au over 4.0 meters.

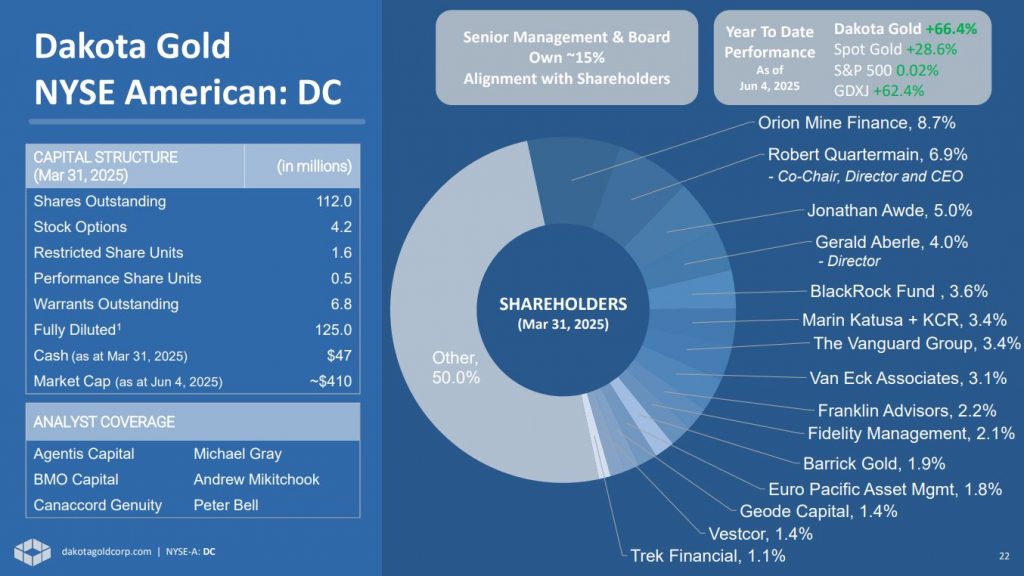

With the recent financing announced March 20, 2025, the Company currently has a cash balance of $47 million as noted in the filed 10Q as at March 31, 2025, and is fully financed through the IACF and the subsequent completion of its Feasibility Study on the Project.

If you have any questions for Bob Quartermain regarding Dakota Gold, then please email those in to me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Dakota Gold at the time of this recording, and may choose to buy or sell shares at any time.

Click here to follow the latest news from Dakota Gold

.

.

As Gold Pushes Higher, Junior Miners Begin to Show Signs of Life

Equity Insider – 27 May 2025

“As gold prices remain favourable, analysts are watching for breakout moments across the junior mining space, with RUA GOLD Inc. (TSXV: RUA) (OTCQB: NZAUF), Luca Mining Corp. (TSXV: LUCA) (OTCQX: LUCMF), Probe Gold Inc. (TSX: PRB) (OTCQB: PROBF), Dakota Gold Corp. (NYSE-American: DC), and Montage Gold Corp. (TSX: MAU) (OTCQX: MAUTF).”

“Despite a 40% gain in the gold price since 2019, junior valuations remain deeply discounted—still hovering near pre-COVID levels. Analysts at Jefferies and InsideExploration note this disconnect, suggesting a re-rating could be overdue if current price strength persists. Veteran investor Rob McEwen and billionaire John Paulson both see $5,000 gold within reach, while JPMorgan recently projected a potential path to $6,000 if even a sliver of U.S.-held foreign assets are reallocated toward bullion. For investors scanning the horizon, catalysts are beginning to emerge.”

https://ceo.ca/@newswire/as-gold-pushes-higher-junior-miners-begin-to-show-b454e